what food items are taxable in massachusetts

This guide includes general information about the Massachusetts sales and use tax. Prepared foods including meat poultry or fish itemsfried chicken or barbecued spareribs for exampleare taxable if sold heated.

Washington Sales Tax For Restaurants Sales Tax Helper

Massachusetts imposes a 625 sales and use tax on all tangible physical products being sold to a consumer and on certain services.

. 2022 Massachusetts state sales tax. Exact tax amount may vary for different items. Most food is exempt from sales tax.

The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam or certain. Items above 175 are taxable at the statewide Massachusetts rate of 62510 мая. Heated foods salads and sandwiches and cheese and finger-food platters under 4 will.

44 rows In the state of Massachusetts sales tax is legally required to be collected from all tangible. In Massachusetts all clothing and footwear items at 175 or less are exempt from sales tax. Food sold by a business that is primarily engaged in the business of selling meals is taxable at the Massachusetts meals tax rates.

Groceries are generally defined as unprepared food while pre-prepared food may be subject to the restaurant food tax rate. These businesses include restaurants cafes. The Massachusetts state sales tax rate is 625 and the average MA sales tax after local surtaxes.

The exemption for food includes. The Massachusetts state sales tax rate is 625 and the average MA sales tax after local. Collecting sales tax when 4-H groups sell products Even though 4-H is an organization that is not required to pay income tax to the state or federal government 4-H organizations are not.

Heated foods salads and sandwiches and cheese and finger-food. 53 rows When foods are categorized as necessities based on nutritional value soda and candy are among the first products to be added to the taxable list. Candy and soda may be included or excluded from any.

It describes the tax what types of transactions are taxable and what both buyers and sellers must do to. Sandwich meats or cheeses sliced or whole and whole cooked meat poultry or fish sold unheated are not taxable. Although Massachusetts still levies a 625 percent sales tax on most tangible items there are quite a few exemptions including food healthcare items and more.

Its sales tax base is narrowly. Food must meet these. Massachusetts has one sales tax holidays during which certain items can be purchased sales-tax free.

Sales Tax Massachusetts Taxpayers Foundation

The Massachusetts Sales Tax Holiday Is Back In August Here S What To Know

Is Dog Food Taxable In Massachusetts

What Is Not Taxed In Massachusetts Town Of Douglas Ma

Sales Tax Massachusetts Taxpayers Foundation

Sales Tax Guide For Landscapers Mass Gov

How Much Is Tax On Catering Caffe Baci

Sales Tax By States Are Dietary Supplements Taxable Taxjar

Surprising Things Your State Taxes Cheapism Com

Ohio Sales Tax Small Business Guide Truic

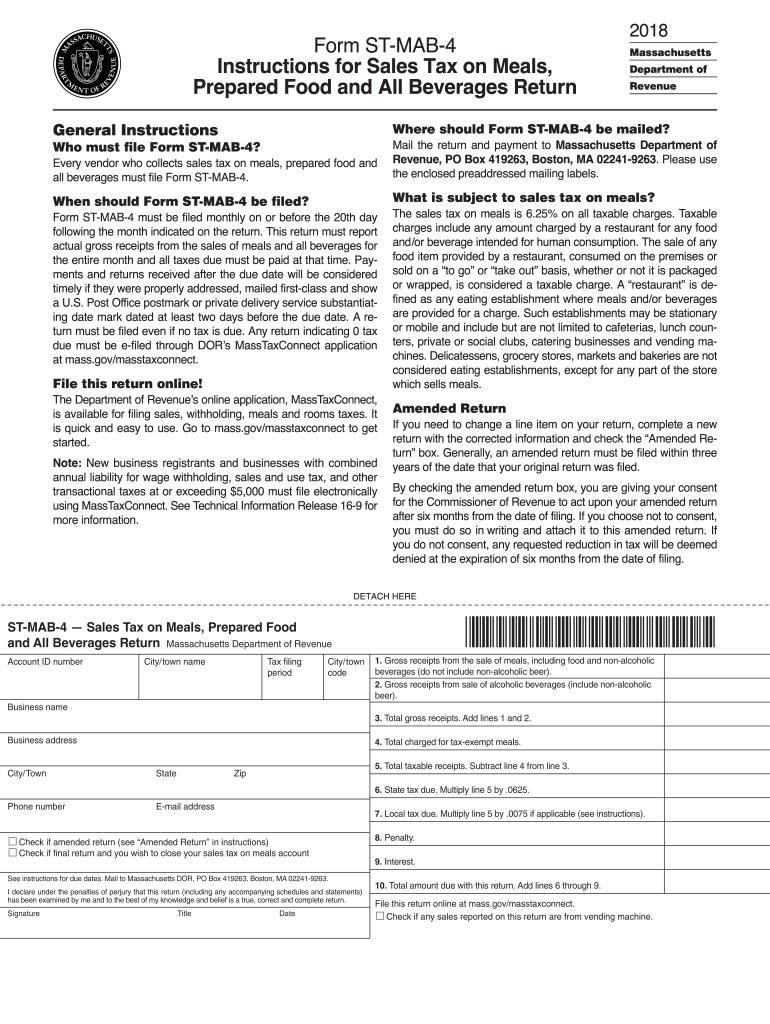

Ma St Mab 4 2018 2022 Fill Out Tax Template Online Us Legal Forms

Massachusetts Sales And Use Tax Audit Guide

Is Food Taxable In Massachusetts Taxjar

Sales Tax Massachusetts Taxpayers Foundation

Restaurant Taxes Sales Tax Federal Tax And Payroll Taxes On Food Biz

/images/2022/01/18/individual-tax-rates-by-state.png)

Here Are The States Where Tax Filers Are Paying The Highest Percentage Of Their Income Financebuzz

Massachusetts Retirement Taxes And Economic Factors To Consider

Massachusetts Sales And Use Tax Audit Guide

What Items Are Subject To Sales Tax In Massachusetts Town Of Douglas Ma